Second wave of a global “shipping nightmare” now taking shape – expect SHORTAGES of everything

08/18/2021 / By JD Heyes

For weeks we’ve been warning about a coronavirus-induced supply chain disruption that was only going to get worse before it gets better.

Well, over the past 48 hours, the situation definitely got worse. Much worse.

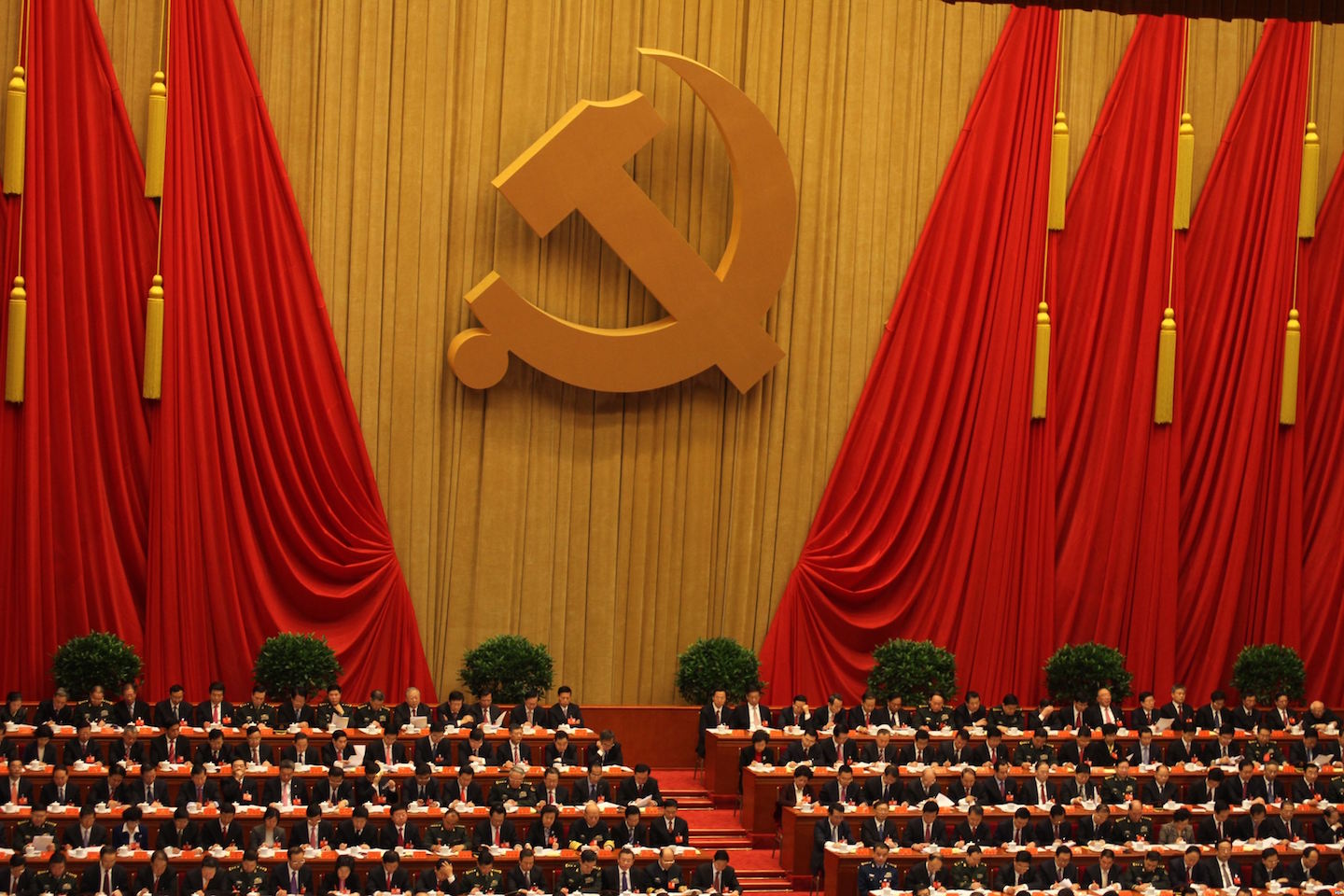

On Monday Natural News reported that Western supply chains were already in peril thanks to a combination of worker shortages, transportation shortages, and a shutdown of China’s biggest shipping port, which also happens to be the largest shipping port in the world.

“The world’s largest shipping port by cargo tonnage has shut down one of its key terminals following a confirmed case of Covid-19, putting further strain on the global shipping industry and disrupting supply chains,” the South China Morning Post reported as well.

“The news came as container shipping rates from China and Southeast Asia to the east coast of the United States hit a record high of more than US$20,600 per 20-foot equivalent unit (TEU) – the standard measure for freight container volume – according to the Freightos Baltic global container freight index,” the paper reported.

A single COVID-infected dock worker caused that shutdown, but the problem is, Chinese officials said the port would be closed indefinitely.

Now, the situation has worsened: America’s largest port, in Los Angeles, which suffered a slowdown in June in response to a Chinese port closure, is backed up, short on dock workers, and will now see another wave of missed shipping dates thanks to the new Chinese port closure.

And all of this comes at a time when shipping prices are skyrocketing even among tepid global demand, which only adds to the final expense of [enter the name of any imported product you want].

Rabobank’s Michael Every tied all of this together in a note to investors on Monday to include the rapidly rising inflation.

He noted that “the US PPI print yesterday laid bare the surge in input costs still coming through the pipeline, most notably in that while the headline was up 1.0% m/m, almost double expectations, and 7.8% y/y, the core component ex- food and energy also spiked 0.9% m/m and 6.2% y/y. As we have already seen in China, somebody is going to have to swallow that. Will it be producers, compressing their margins? Or will it be consumers, depressing their real incomes?

“Considering around 25% of capacity at China’s third-busiest port just closed down again due to Covid-19, which will push global shipping further past its limits just as the US needs to restock for Black Friday and Xmas, the one thing that does not seem likely is a rapid drop-off in supply-side inflation,” Every added.

Port closures and slowdowns, shipping delays, and a lack of infrastructure to get goods to market — remember, we have a nationwide truck driver shortage, too — all means one thing: Prices will continue to rise.

Not all of this inflation is the fault of lowered supply, however. Monetary and fiscal policy coming from majority Democrats and the Biden regime are essentially flooding the country with liquidity under the guise of “COVID relief” but are really pouring more money into an economy hampered with supply disruptions, which means there are fewer goods for all of that money.

What does that historically mean? Inflation. More dollars competing for less stuff means the people with the stuff get to charge more for it. And it’s hurting working families.

“Call it the ‘Biden pay cut,’” Alfredo Ortiz, CEO of the Job Creators Network, a conservative U.S. advocacy group, told Fox Business Network. “Rapid inflation and declining real wages are the direct result of the Biden administration’s historic spending that is overheating the economy and creating disincentives to work.”

Added the network: “The prolonged jobs recovery has made it more difficult to rectify the supply-chain disruptions caused by the pandemic.”

Brace yourselves, because the worst is yet to come. We’re only just now seeing the beginning of this financial tsunami.

Sources include:

Tagged Under: Biden regime, chaos, China, Collapse, economic policy, global supply chain, goods, Inflation, Joe Biden, Los Angeles, shipping, shortage, supply chain, supply lines, transportation

RECENT NEWS & ARTICLES

COPYRIGHT © 2017 PREPAREDNESS NEWS